Have you ever dreamt of growing your business by importing goods from China or other global markets to India? But did you feel overwhelmed by the legal paperwork involved?

You're not alone.

Many Indian business owners like you face a common problem. They struggle to understand the legal documents needed for importing goods to India. It feels like a puzzle no one explains in plain language. The rules seem complicated. Departments do not use clear language. You feel stuck between consultants, freight agents, and clearing officers.

This guide is here to change that.

You might be a small trader in Surat importing textiles. You could be a B2B wholesaler in Delhi, sourcing electronics from China. Or, you may be a startup founder in Bangalore bringing in machinery. This new legal guide will help you import confidently and follow the rules.

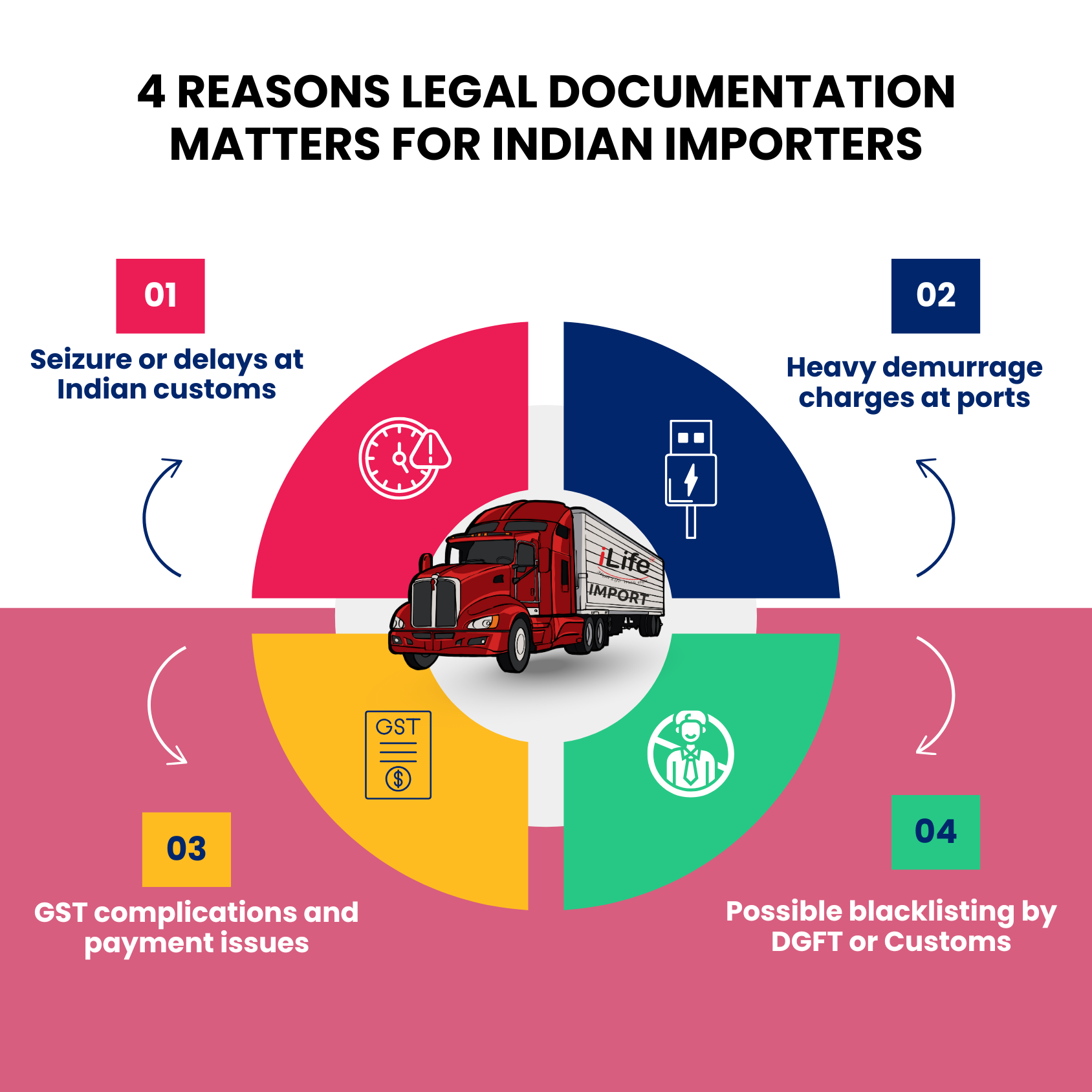

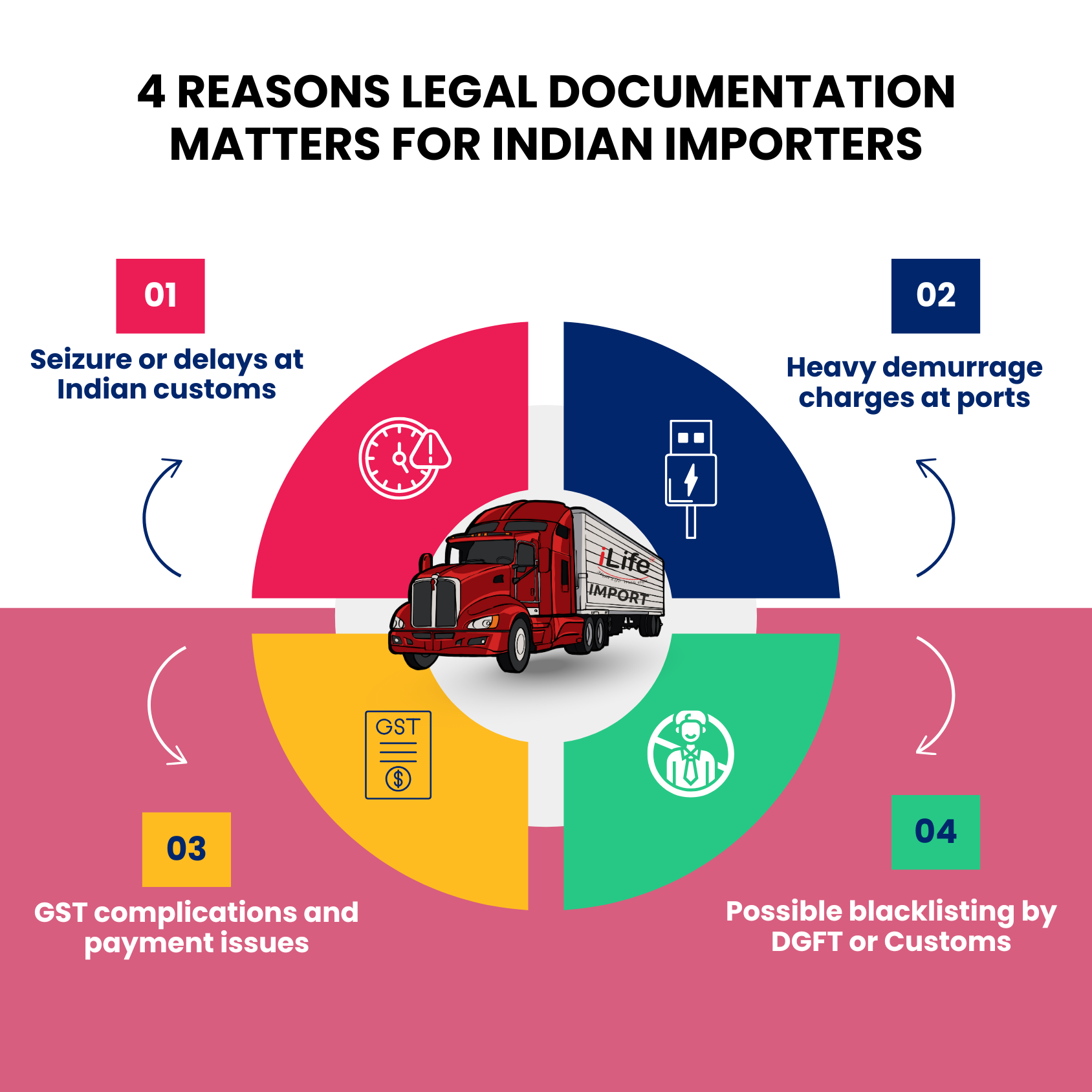

Why Legal Documentation Matters for Indian Importers?

Before we dive into the paperwork, let’s answer a heartfelt question:

Why should you care so much about legal documents when importing goods?

The truth is, your entire import business depends on it. Improper documents can lead to:

Seizures or delays at Indian customs. If you don’t have legal papers for your business, a customs officer will hold your shipment. There is a 0.5% chance of freeing those goods once you fail to prove legality.

Heavy demurrage charges at ports. If your Bill of Lading has wrong information, the port authority may seize the goods when the container arrives. To release it, you have to pay the amount as instructed.

GST complications and payment issues. To do business in India, you must register for GST. However, a proper GSTN is necessary to handle the tax filing complications and foreign trade payment issues. To proceed with the international methods, your bank requires the GSTN, and if not, there’s no way to pay the trading amounts.

Possible blacklisting by DGFT or Customs. If your business documents are false or misleading, the Indian government can cancel your IEC code. Also, the customs department will not allow global trade with international traders.

To grow your business, you need to get your goods quickly. It's also important to avoid legal problems. To do this, learn the import documentation rules in India.

List of Legal Documents For Importing

Here is a complete list of legal documents required for landing goods in India from other countries:

1. Importer Exporter Code (IEC Certificate)

2. Proforma Invoice and Purchase Order

3. Commercial Invoice and Packing List

4. Bill of Entry (BoE)

5. Bill of Lading (for Sea) / Airway Bill (for Air Cargo)

6. Insurance Certificate

7. Certificate of Origin (COO)

8. Insurance Certificate

9. Product-Specific Licenses or NOCs

10. AD Code Registration and Bank Remittance Proof

It’s time to understand the role of these documents in foreign trade.

1. Importer Exporter Code (IEC Certificate)

If importing is the journey, the IEC (Importer Exporter Code) is your passport. It is a unique 10-digit code given by the Directorate General of Foreign Trade (DGFT). Every importer in India must have it.

Without this code, you simply cannot legally bring goods into the country. Whether you are a solo entrepreneur, a partnership firm, or a private limited company, IEC applies to all.

You have a question: how do you get the importer-exporter code?

The best news is it’s fairly easy to apply online through the DGFT portal.

You’ll need the following documents representing your business:

-

Business PAN Card

-

ID Proof (a copy of a valid ID proof like a Passport, Aadhar Card, or Voter ID)

-

Address Proof (sale deed, rent agreement, lease deed, or utility bills (like electricity or landline bills)

-

Bank Account dedicated to Business

-

Proof of Establishment/Incorporation (for a company, you'll need a certificate of incorporation or similar proof)

-

Proof of Partnership/Other (for a partnership firm, you require a partnership agreement)

Most organizations issue IECs within 15–20 working days. Once obtained, it’s valid for a lifetime. The system links IEC to the ICEGATE Customs portal for seamless filing of import documents.

Without it, you cannot clear goods, send money to foreign suppliers, or file customs paperwork. This is your first, non-negotiable step.

2. Proforma Invoice and Purchase Order

In international trade, especially when importing, you need two important documents.

1. Proforma Invoice

2. Purchase Order

Without them, your trade is incomplete, and you can’t get a green signal from a customs department in India.

1. Proforma Invoice

These two are the foundation of every international transaction. The Proforma Invoice is a formal quote from your supplier. It includes detailed product descriptions, prices, quantities, HS codes, and agreed Incoterms like FOB or CIF. People consider it a promise, an estimate of what you will receive and how much it will cost.

2. Purchase Order

The Purchase Order (PO), on the other hand, is your formal acceptance of the offer. Your internal document mirrors the details of the proforma invoice, confirming your intent to purchase. Customs authorities may ask for these to verify your intent and ensure there’s no misdeclaration.

Both documents set the tone for the entire trade process. A mismatch in pricing, HS codes, or Incoterms can lead to customs delays or even rejection of goods. That’s why it’s important to keep your invoice and PO aligned, stamped, and backed by a clear agreement with your overseas supplier.

3. Commercial Invoice and Packing List

Do you think having a proforma invoice and purchase order is enough to import goods from another country? No. It’s not enough. There are other important legal documents required: 1. Commercial invoice, and 2. Packing list.

1. Commercial Invoice

These are among the most important documents reviewed by Indian Customs. Your supplier sends the Commercial Invoice as the final bill once they dispatch the goods. It includes product details, price per unit, total value, currency, payment terms, and the supplier’s and buyer’s names. This invoice is what Customs uses to determine the assessable value for duty calculation.

2. Packing List

The Packing List accompanies the invoice and provides physical shipment details, box-wise breakdown of goods, number of units, dimensions, and net/gross weight. These documents must precisely match the Bill of Lading and Bill of Entry. Even a slight mismatch in weight or quantity could trigger a customs inspection or delay.

For you as an Indian importer, these two documents form the core of your documentation set. They validate your trade value, reduce ambiguity, and speed up clearance. Never underestimate the importance of accurate, consistent formatting across both.

4. Bill of Entry (BoE) - The Key to Legal Clearance at Customs

This is your official declaration to Indian Customs that you're importing goods into the country. The Bill of Entry (BoE) is filed electronically on the ICEGATE portal by your Customs House Agent (CHA) or clearing agent. It includes important details such as:

-

The importer’s IEC

-

GSTIN

-

HS code

-

Product Value

-

Applicable duty

Customs officials assess this document to calculate customs duties (Basic Duty, IGST, SWS, etc.) and check that the goods comply with Indian regulations. The BoE also links to your shipping documents, commercial invoice, and packing list. Once approved, Customs procedure issues an Out of Charge (OOC) order, which allows goods to be released from the port.

A late or incorrect BoE filing can lead to detention, demurrage, and costly delays. In simple words, this is the core part of your customs clearance process. Without it, your goods are stuck, and you can’t sell, claim GST, or move forward.

Moving forward with other important legally binding documents in foreign trade is required, especially when importing goods in India.

5. Bill of Lading (for Sea) / Airway Bill (for Air Cargo) - Your Legal Shipping Receipt

When you import goods by sea or air, you need certain documents. We call these a Bill of Lading and an Airway Bill. This is the proof that your goods are actually in transit.

The Bill of Lading (B/L) and the Airway Bill (AWB) are documents known as bills of exchange. The shipping company or airline provides them.

This happens after they receive your cargo. It is a transport document. It shows how goods move from the supplier to your destination port in India.

It includes key information like:

It also indicates who owns the cargo. If someone consigns it to you directly or to your CHA.

Why is this important?

Without the B/L or AWB, you cannot claim or clear your cargo from Indian ports. People also use it to release the goods from the carrier. Many importers think the shipping company will handle everything. However, you must check every line of this document before shipping begins.

6. Insurance Certificate - Protect Your Shipment Against the Unexpected

If the shipping method is CIF (Cost, Insurance, Freight), your supplier must pay for insurance during transit. However, many Indian importers prefer to get their insurance for better coverage or to meet financing/banking requirements. In either case, an Insurance Certificate is essential.

This certificate proves that your goods are protected against risks in the following situations:

- Theft

- Fire

- Water damage

- Mishandling during transit

Indian Customs may ask for this, especially if there's a damage claim or loss report. It also helps you claim insurance compensation swiftly in case of mishaps.

Make sure your policy clearly mentions the value of goods, point of origin, destination, and transport mode. For high-value or fragile items like electronics, glass, or machinery, insurance isn’t optional; it’s mandatory. Even one small accident can wipe out lakhs of rupees, so don't skip this step.

7. Certificate of Origin (COO) - Unlock Duty Benefits & Prove Authenticity

A Certificate of Origin is a document that certifies where the goods were manufactured. It is very important if you are importing goods under Free Trade Agreements (FTAs). This includes the India-ASEAN FTA, India-Korea CEPA, and India-Japan CEPA. If you don’t present a valid COO, you lose out on preferential duty benefits, often up to 10–20% in savings.

But if you’re importing goods from foreign countries for the first time, you may wonder where to get this certificate.

There are two prominent ways:

- It is issued by the supplier’s local Chamber of Commerce

- Government-authorized body

COO must be original, signed, and stamped. Some importers also get it electronically but ensure Indian Customs accepts that version.

If you are importing generic goods like garments, machinery, or electronics from FTA countries, always confirm with your supplier to send a COO before shipping. Missing this document can mean higher duties, delay in clearance, or Customs holding your cargo for verification. In short, the COO directly affects your profitability.

8. GST Registration Certificate - For Transparent Taxation and Input Tax Credit (ITC)

If you run a business that sells goods or services, you need a GSTIN. This stands for Goods and Services Tax Identification Number. It is a legal requirement in India. For importers, though, it’s more than just a compliance rule; it’s a smart financial tool.

Here’s why: when your goods arrive at an Indian port, you must pay IGST (Integrated GST) during customs clearance. Without a valid GSTIN linked to your IEC and port records, this amount becomes a non-refundable cost.

You can’t claim it as an Input Tax Credit (ITC) in your returns. With a proper GSTIN, however, the same tax turns into a recoverable credit, significantly improving your bottom line.

Make sure you correctly link your IEC and GSTIN and keep your GST portal up-to-date. If you operate from multiple locations, register in all states where you may deliver goods. From Customs clearance to tax accounting. Your GST number plays a good role in every step of the import process.

9. Product-Specific Licenses or NOCs

Don’t think you can import all products freely into India. You may need special permissions, licenses, or NOCs from certain Indian regulatory bodies. This depends on the type of your goods.

For example:

- FSSAI license for food, beverages, and edible items.

- CDSCO license for cosmetics and pharmaceutical goods, including raw materials.

- BIS certification for electronics, batteries, and certain home appliances.

- Explosive License for chemicals or hazardous materials.

These documents are over and above the general import documents. If your cargo has "restricted" or "prohibited" HS codes, you may need special import permission from DGFT.

If you fail to obtain the necessary NOC, your shipment could face rejection or sealing at the port. Before you place an order, talk to a compliance expert or your CHA. They can tell you if your product needs extra documents.

10. AD Code Registration and Bank Remittance Proof

Every importer must register their Authorized Dealer (AD) Code with the port where their goods arrive. Your bank issues the AD Code (the one used for foreign remittance), and you must submit it to Customs via ICEGATE. Without this, you cannot file a Bill of Entry or pay duties.

Why does it matter? AD Code ensures that RBI can track all foreign currency transactions and match them with your imports. It’s a safety and compliance measure, not a cheap formality.

Also, you must retain proof of bank remittance (SWIFT copies, foreign inward remittance certificates, etc.) for each transaction. These help in audit trails, DGFT records, and GST compliance. Banks also demand these documents when you're importing under a Letter of Credit (LC).

Think of AD Code as your financial handshake with Customs. Once you register, it ensures your funds and goods align, reducing clearance issues.

|

Document

|

Mandatory (Yes/No)

|

Notes

|

|

IEC Code

|

✅

|

Apply via the DGFT portal

|

|

Proforma Invoice

|

✅

|

From your supplier

|

|

Purchase Order

|

✅

|

Internal record

|

|

Commercial Invoice

|

✅

|

For Customs valuation

|

|

Packing List

|

✅

|

Must match the cargo

|

|

Bill of Entry

|

✅

|

Filed on ICEGATE

|

|

Bill of Lading / AWB

|

✅

|

Shipping proof

|

|

COO

|

Conditional

|

Required for FTA duty claims

|

|

Insurance Certificate

|

Conditional

|

If not arranged by the supplier

|

|

Product NOC

|

Conditional

|

For food, cosmetics, electronics, etc.

|

|

GST Registration

|

✅

|

Needed for IGST & ITC

|

|

AD Code

|

✅

|

Port-wise registration

|

Are you searching for a trustworthy import consultancy partner or CHA?

iLife Import is a good option for your business.

How iLife Import Helps You Stay 100% Compliant

At iLife Import, we’ve helped 500+ Indian importers safely navigate customs and legal documentation.

Here’s how we make your life easier:

- Document Filing Assistance (BoE, AD Code, COO)

- Customs Compliance Review

- Port-specific Consultancy

- Real-time Updates for Policy Changes

- Free Checklist Templates for New Importers

We believe you should focus on growing your business, not running behind paperwork. Let us handle the documentation jungle while you enjoy peace of mind and faster clearances.

Conclusion: It’s a Smart, Compliant Growth Strategy

Importing goods into India doesn’t have to be overwhelming. With the right legal documents in place, you're not just complying with the law; you’re protecting your business. Every form, invoice, and certificate plays a delicate role in smooth customs clearance. So, take it step by step.

If you ever feel stuck, iLife Import is here to guide and support you.

Because your business deserves to grow without legal roadblocks. Contact us now.